Do You Really Understand Bitcoin?

When we talk about Bitcoin’s security, words like “hashrate,” “51% consensus,” and “decentralization” usually come to mind. But what if these are just the tip of the iceberg?

Today, let’s dive beneath the surface and uncover the real foundation of Bitcoin’s security from a nearly philosophical lens. Its greatest design is not brilliant code — it’s that it successfully implanted a physical-world heart: time.

Ready? This may reshape the way you think.

First, we must understand that all formal systems (including software) come with a built-in ceiling. In the computer world, everything is computable.

But there’s one type of problem computers can’t solve: self-referential decisions. The classic example in Bitcoin is the Double-Spending Problem. Once a transaction (TX) is sent, it enters a kind of Schrödinger’s Cat state: It might be confirmed or might not be.

When someone attempts to spend the same coins in two transactions, how can the system determine which is valid? This creates an undecidable problem — the system cannot internally compute with 100% certainty whether a transaction is already on-chain.

This local “uncertainty” aggregates into a system-wide “incompleteness” — the Fork Problem.

Which version of the chain is the “real” one?

Again, a self-referential paradox.

Paradox chain: Double-spending (local) → State uncertainty → Forks (global)

Traditional systems try to patch this with more rules, but structural instability can never be truly eliminated.

If the system itself cannot make a final judgment, an external force must intervene. In computer science, this is called an Oracle — a God-like component that makes non-computable choices.

In Bitcoin, this “oracle” role is played by the miners.

Every block is born from an oracle judgment made by a miner. Thus, Bitcoin becomes a decentralized oracle system — with countless local, uncomputable choices driving forward global evolution.

Many people mistakenly believe Bitcoin’s security comes from “voting consensus” — that if 51% are honest, the system is safe.

This is a huge misunderstanding.

Bitcoin’s security is a byproduct of its pursuit of precision.

Think of building a bridge — we seek extreme engineering precision, not a vote to decide if it’s solid.

If the structure is precise enough, safety follows. When you buy Bitcoin, you’re essentially buying its commitment to the irreversibility of time — a commitment born from extreme structural precision.

Traditional consensus algorithms (like BFT) rely on logic-based “irreversibility” — gentleman’s agreements that can be reversed in theory.

Why? Because all Turing-machine-based computations are reversible in essence. So what counts as true physical irreversibility?

Time and energy.

A broken egg can’t be unbroken. A burned log can’t be restored. That’s the core of Nobel laureate Prigogine’s Dissipative Structure Theory:

An open system far from equilibrium, maintaining stable order through constant energy dissipation and exchange with the environment.

Life itself is the most typical dissipative structure.

Bitcoin is the first to bring this physical principle into the digital world.

Now, Bitcoin reveals its true form:

A thermodynamic time-driven, living digital dissipative structure.

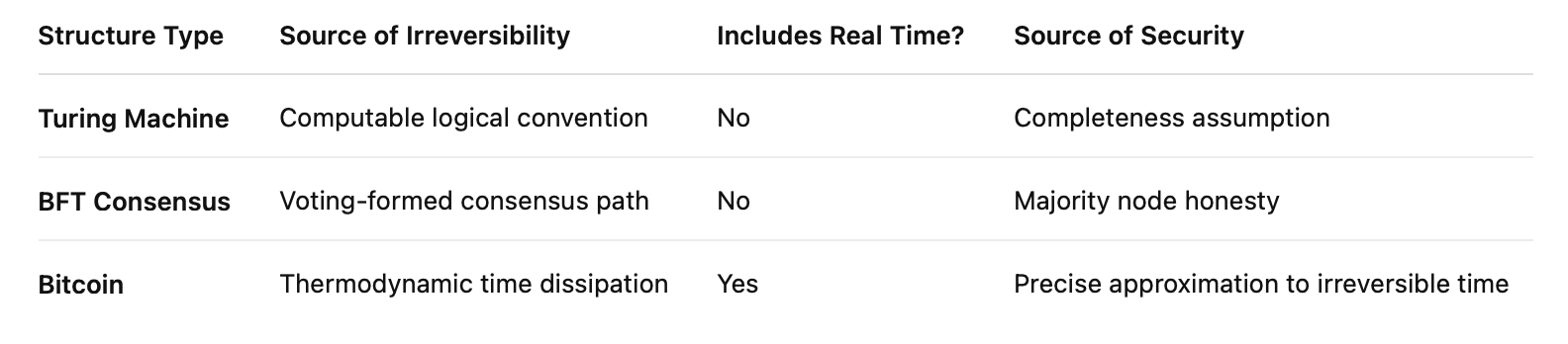

Let’s use this table to summarize the fundamental differences between Bitcoin and other systems:

Conclusion: All systems that exclude real time are ultimately imprecise — and therefore insecure.

Bitcoin’s greatness lies in this: It doesn’t try to resolve paradoxes within formal logic. Instead, it adds a “physical plugin” — real-world time and energy — to force irreversibility into system evolution.

This is no longer just logical deduction in the virtual world. It’s a structure that, via the one-way flow of time and energy, continuously approaches systemic absolute precision.

A dissipative time-trust machine.

A self-consistent system that welds physical time into formal logic.